- #QUICKBOOKS SMALL BUSINESS TRACK MILEAGE FULL#

- #QUICKBOOKS SMALL BUSINESS TRACK MILEAGE PRO#

- #QUICKBOOKS SMALL BUSINESS TRACK MILEAGE SOFTWARE#

- #QUICKBOOKS SMALL BUSINESS TRACK MILEAGE PLUS#

- #QUICKBOOKS SMALL BUSINESS TRACK MILEAGE PROFESSIONAL#

The self-employed version has a free plan, Premium $8 per month plan and Premium Plus $12 per month plan. And if you need to make any notes or take photos of your trip, you can easily link it to the journey in the app.Įverlance offers two versions of its app-one for self-employed workers and one for small businesses.

You can classify both mileage and expenses as personal just by swiping, as well as download Microsoft Excel files or PDFs of your data anytime. Of course, there’s also the option to manually add a trip if the app doesn’t record it for some reason. It offers automatic GPS tracking with intelligent drive technology that knows when you start a trip.

QuickBooks Online is best for self-employed people or independent contractors who only need to track their miles for tax purposes.Įverlance is one of the best mileage tracker apps if you’re only focused on tracking miles and expenses.

#QUICKBOOKS SMALL BUSINESS TRACK MILEAGE FULL#

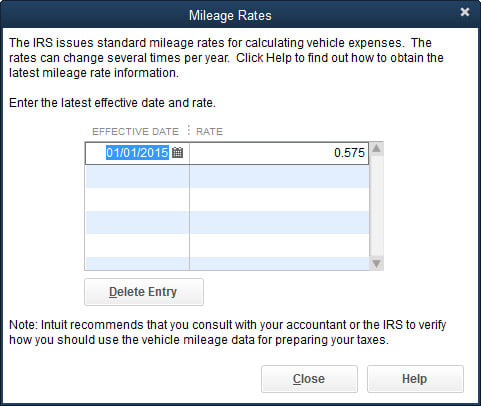

For more information read our full QuickBooks Online review. If you need more users, you can choose the Essentials ($55 per month), Plus ($86 per month) or Advanced ($200 per month), but these are too expensive if all you want is mileage tracking. This is the plan we’d recommend for most people. For the Simple Start plan, you’ll pay $30 a month and get the ability to track income and expenses, capture receipts and track sales tax. While all plans are 50% off for the first three months, its normal prices are a bit high. However, it should make it easy to report deductions come tax time. The app uses the preset IRS mileage rate, which can be a bit frustrating if you’d like to set your own rate for compensating employees. If you don’t have your phone with you on a trip, you can also enter your miles manually.ĭetailed mileage reports let you break down all of your miles and potential deductions. It works by using GPS, meaning you don’t have to do any special planning to start your trip. The app lets you distinguish business versus personal miles, which is good if you use a personal vehicle for business. QuickBooks online is an extremely popular accounting software, but it’s not as well-known for its mileage tracking capabilities.

#QUICKBOOKS SMALL BUSINESS TRACK MILEAGE PROFESSIONAL#

While any small business could use Rydoo, it’s best for professional services or tech, construction and manufacturing companies with more than ten traveling employees. There’s also an Enterprise plan with pricing based on your needs that comes with API access and premium support.Īll plans have a minimum of ten users, so this likely isn’t the best option for very small businesses or entrepreneurs.

#QUICKBOOKS SMALL BUSINESS TRACK MILEAGE PRO#

This comes with unlimited expenses, automatic mileage expense calculation based on your customized mileage rates and integrations with Uber, Lyft and Slack.įor $12 per user, per month (billed annually), the Pro plan lets you set per diem and daily allowances as well as gain access to accounting integration with QuickBooks, Zero and Exact Online.

The Essentials plan is $10 per user, per month, when billed annually or $12 per user, per month, with monthly billing. Then, after you add in preset mileage rates, the app will calculate the total driving distance and expenses right away. Mileage tracking requires the employee to plan their trip using the Rydoo integrated map service. It also comes with insight capabilities to show where your business might be overspending. It lets you set policies with spending limits and create warnings when an expense doesn’t fit the policy.

#QUICKBOOKS SMALL BUSINESS TRACK MILEAGE SOFTWARE#

Rydoo is another expense management software that covers everything from claims to reimbursement. Zoho Expense is best for businesses with employees that would benefit from highly customizable and integrated travel tracking. The $5 per user a month (if billed annually) plan adds on unlimited receipt auto scans and purchase requests, while the $8 per user a month (if billed annually) plan offers online travel agency and travel management company integration.Īll plans allow you to receive direct reimbursement from the app, track multicurrency expenses and integrate with Zoho Books, QuickBooks Online and Xero to make organizing finances simple. For $3 per user a month (if billed annually), you can add on more users and gain corporate card reconciliation and access delegation. Zoho offers four distinct plans, with a rare free option that gives you up to three users, 20 receipt auto scans per user and 5 GB in receipt storage. For more automated readings, you can start GPS tracking in the app when you begin driving, enter a start and end location or enter your car’s odometer reading. The distance covered option lets you enter miles and then automatically calculates the total costs based on a preset rate per mile or kilometer. Zoho Expense is a robust travel and expense management app featuring automated expense reporting with four different ways to track mileage.

0 kommentar(er)

0 kommentar(er)